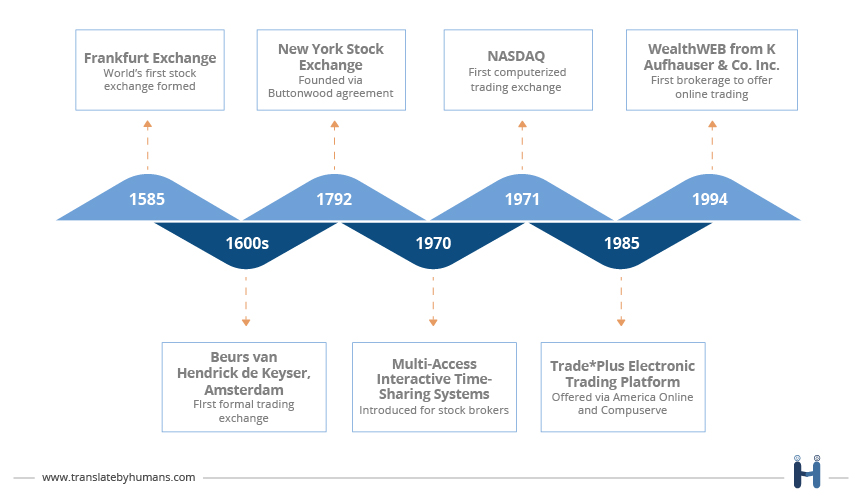

Electronic trading platforms and applications are widely accepted and extensively used by traders and investors today, but they are relatively recent entrants in the trading business. Stock exchanges have been around for at least four centuries, if not longer. Interestingly, the first reference to a “public” company, prices of which may have fluctuated, dates back to the era of the Roman Empire!

Even so, trading of financial assets largely remained a “face-to-face” activity wherein a buyer and seller, or their agents, would at some point meet and interact and carry out the trade. The images of brokers engaging in open out-cry on exchange floors would be quite nostalgic for some of the stalwarts of the industry. This went on until the first paradigm shift came in the early ’70s with the development in telecommunications.

Modern Times

NASDAQ came into being as a computerised trading exchange, eliminating the need for physical stock certificates. However, the seeds of today’s burgeoning online trading volumes were sown in 1982, when Trade-Plus was founded by the physicist William Porter before the Web came into being.

A decade later, it was renamed E-trade which offered an electronic trading platform via AOL (America Online) and CompuServe. While these were meant for industry experts, by mid-90s the e-trading terminal was taken to investors as brokerage firm K. Aufhauser & Co. brought online trading through WealthWEB and TransTerra’s launch of Accutrade for Windows ushered in the era of online investing via downloadable software and web-based trading.

Today’s Trade

Fast forward to now, and we see global trade being shaped by the internet with firms of all sizes big and small offering online trading platforms. Not only that, the current decade has seen another revolution in the form of smart-phones, which has led to brokers placing the trading terminal in the customer’s palms via mobile applications or apps. Today, a person sitting in a lounge in Tokyo can take a trading position of a company based in India on an exchange in London, all within a matter of seconds!

As the global community of market participants grew, more asset types have been created, and today we find a wide array of tradable financial assets from stocks, bonds and commodities to derivative contracts on these as well as currencies and the newest asset to catch the fancy over the last couple of years – cryptocurrency!

The regulations governing the markets have also seen constant evolution and come with their own complexities and dualities as one trades across boundaries. Trading in blockchain-based cryptocurrencies is a good example, where regulations around the globe are still evolving even as the trade has gone rampant and taken the markets by a storm. While we hear of new ICOs (Initial Coin Offerings) hitting the markets every day, many countries have regulations that either caution investors of trading in Bitcoin and other cryptocurrencies by distancing the market regulator from cryptocurrency trading oversight or have a blanket ban on them.

The legality of Bitcoin is changing constantly around the world as regulations are formed in support of or against Bitcoin.

Global Opportunities & Challenges

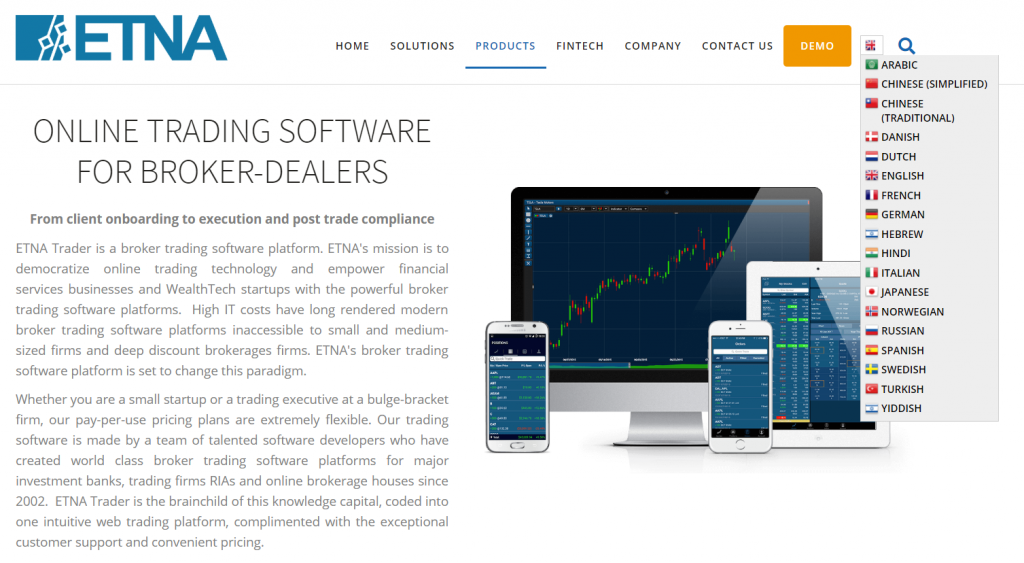

Like all global trade opportunities come with a set of challenges, so does taking the financial trading services overseas. One of the primary challenges is for the offering to be understood by its customers and, to understand the customers in turn. Trading Platforms need to offer a precise, unambiguous interface to its users which has the ability to support investment information and regulatory information, both of which are highly localised and may vary vastly from one country to another. Additionally, they need to provide the same levels of user experience for the traders across their offerings – be it a web trader, a mobile app, or downloadable software. It is also often required to go a step ahead and localise the marketing plan to preserve the brand’s identity and concept of the campaign while making it a culturally perfect fit.

Localisation helps adapt your marketing plan for a specific market. It helps make an offering a customised solution made for that market, and such solutions clearly stand a greater chance to be accepted more readily, thereby helping the product break-out of geographical bounds and reach out to a much wider customer base. Who wouldn’t want a share of the global pie?

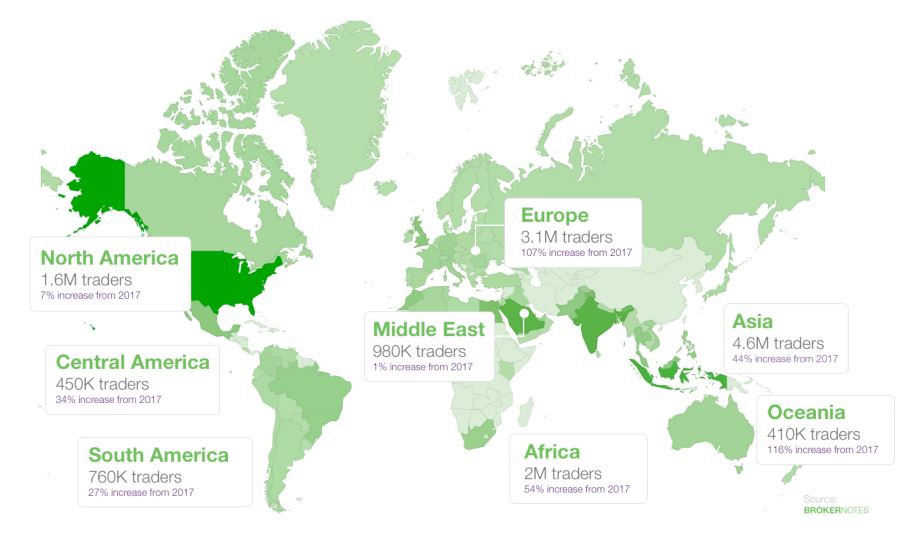

According to a 2018 report published by Broker Notes – an online broker comparison website, there were 13.9 million online traders globally, and their survey helps break the assumption that most traders would be based around financial centres.

The infographic above clearly strengthens the already well-established case for localisation of the trading platforms to provide customers a seamless experience in their native language.

It requires specialised knowledge to localise a trading Platform as diverse aspects starting from marketing information and product demos to regulatory information, financial reports and asset-specific news and information to customer service, all need to be addressed. Here are a few examples to understand this aspect better:

- What information dissemination the Securities Exchange Commission (SEC) in the United States mandates from a market intermediary like a broker could be remarkably different from that mandated by Financial Services Authority [Indonesian: Otoritas Jasa Keuangan (OJK)] in Indonesia, requiring extensive localisation.

- An investor in the United Kingdom looking to invest in the Japanese giant Yahama Corp listed on the Tokyo Stock Exchange (TSE/TYO) might want to refer to the company’s annual report for more information. It would be valuable to have it available in English, which would require high-quality financial translation.

- A new customer in India wants to learn about the features the mobile trading app provides – a demo in Hindi would do the job or even one with subtitles. This would need expert transcreation.

- Crude oil futures are one of the most widely traded derivative contracts around the globe with large, multi-national corporations actively trading and hedging their positions. Quotes would need to be localised as per the country currency and exchange rates.

- Servicing clients through query resolution in their native language either through human interaction or via automated chatbots.

While the need to localise is well established, the benefits are far-reaching. From helping a company penetrate a new geography, build market share, and increase its revenues to helping it retain customers with efficient customer service, it is a must-have for any trading platform provider with global ambitions.

The Future of Trading Platforms

As the universe of probable customers widens, so does the market share, which would ultimately lead to a better top-line for the business. It is a vital competitive advantage to have over others who may not offer their trading platforms with multiple language support.

Where there is a plethora of providers and intense competition to win customers, retaining them is equally important as bringing in new customers. Every touch-point created with the customer should aim at building a rapport and what better way than to provide your customers with effective support in a language they best understand. Multilingual customer service in the form of guides or user manuals, demos, reference material as well as online and offline support is best suited to communicate effectively.

It is, therefore, imperative for trading platforms with global aspirations to have a localisation strategy in place for the markets one intends to compete in, and provide a multilingual solution across its offerings.

In the next article of the financial translation series, we’ll take a detailed look at the web and app-based trading platforms and their many functions.